The bottom line: Outdoor volleyball is thriving, not just surviving. Despite year-round indoor competition, the data shows sustained growth where it matters most.

Key findings:

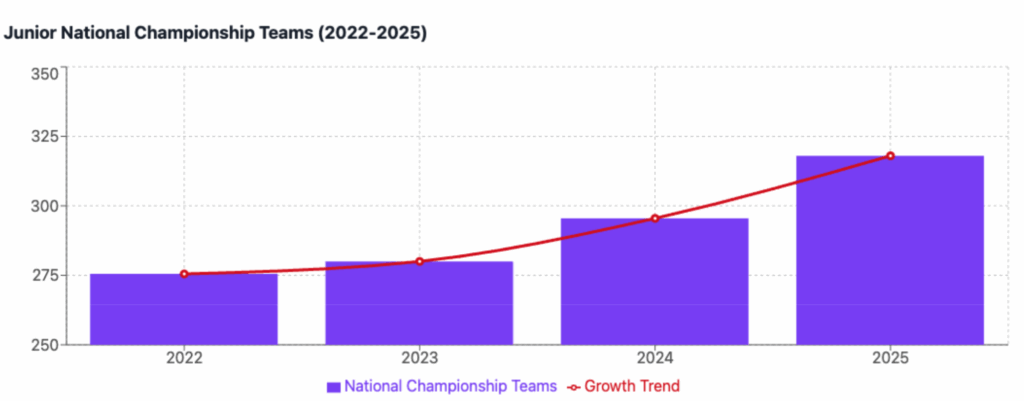

- Destination events are booming: Junior national championships grew 15% (275.5 → 318 average teams), while premier tournaments carry 70+ team waitlists

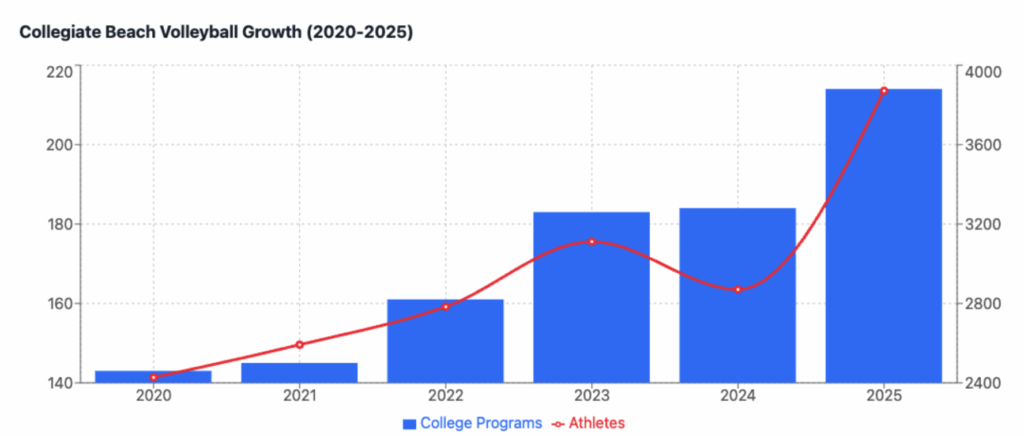

- College beach is expanding: Programs increased 50% since 2020 (143 → 214), with 3,800 athletes competing in 2025

- Demand exceeds capacity: Calendar crowding, not declining interest, explains recent per-event dips; total events and participants are up year-over-year

- Power has shifted to clubs: With six competing junior national championships, club directors now determine which events matter through their investment decisions

Strategic implications: Tournament directors should focus on capacity expansion and calendar consistency. Club directors hold significant influence in shaping the sport’s competitive landscape while navigating a more complex recruiting environment as D1 opportunities plateau.

I. Outdoor Volleyball is Strong Despite Competition

This report is a snapshot of the U.S. outdoor volleyball market from 2020–2025. We set out to answer a few simple questions: Is the market growing, plateauing, or shifting? Do beach and grass volleyball have room to grow, or are we nearing capacity? To ground this conversation in real numbers, we analyzed outdoor data from Volleyball Life, College Beach, and TruVolley. While this dataset doesn’t capture every beach and grass tournament in the country, it represents the vast majority of organized outdoor volleyball events in recent years.

One backdrop to this study: since COVID-19, indoor volleyball has expanded in season length and roster size so aggressively that it has moved from complementing the summer outdoor volleyball calendar to directly competing with it. In many markets, indoor now runs year-round, with off-season workouts, summer tryouts, high school double days, private lessons, clinics, and camps at every level. Because beach and grass volleyball are seasonal in most of the country (thanks to weather and a shortage of indoor facilities), that year-round indoor calendar pulls on some of the same athletes, coaches, and budgets. We’re not making a policy argument, just documenting a structural shift that makes outdoor volleyball’s continued strength all the more noteworthy.

II. Overall Market Health: Steady Demand

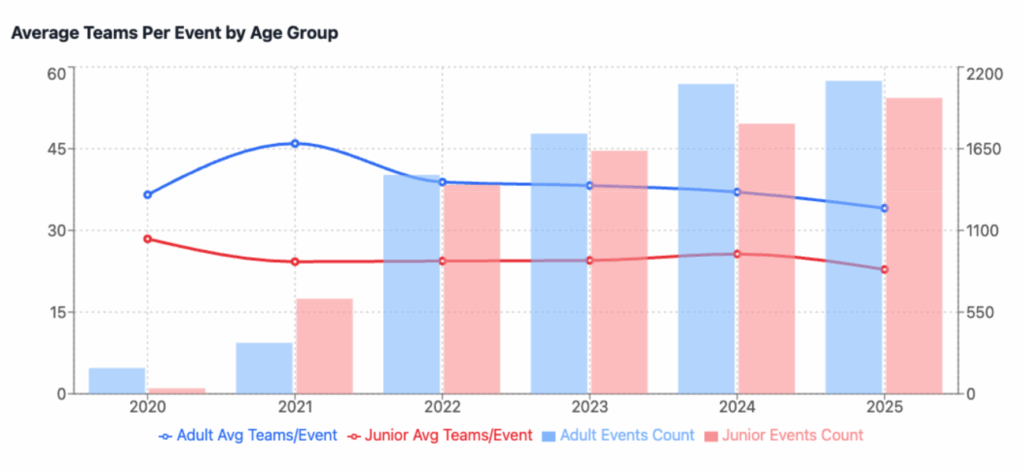

Adult outdoor volleyball participation peaked in 2021 at 45.9 teams per event, the high-water mark of the post-lockdown outdoor boom, when many indoor-only players crossed over to beach and grass tournaments. Since then, adult average teams per event has settled in the high-30s. Juniors have been steadier: mid-20s teams per event throughout, with a small dip in early 2025 that will likely rise as fall/winter events are posted.

Per-event averages have ticked down slightly, but the evidence points to calendar crowding, i.e. more tournaments chasing the same athletes, rather than a true demand decline. The total number of events and unique participants on Volleyball Life are up 19% year over year this summer.

One caveat: it’s hard to measure event growth cleanly because Volleyball Life expanded rapidly in 2024–2025, which inflates raw counts as new clients come onboard. Until platform adoption stabilizes, unique-event totals will overstate market growth. That’s why we emphasize rate metrics (teams per event, fill rates, sell-outs) over raw totals.

III. Where Growth is Happening

Where we’ve seen sustained and verifiable growth is in the year-over-year expansion of (A) the largest annual outdoor events and (B) college beach volleyball. We’re confident in these trends because we have complete multi-year data for these tournaments on Volleyball Life and CollegeBeachVB.com from consistent event organizers, and because we attend many of these events. Watching high level outdoor volleyball is something we love to do when we aren’t at our computers.

A. Destination Events Are Booming at All Ages

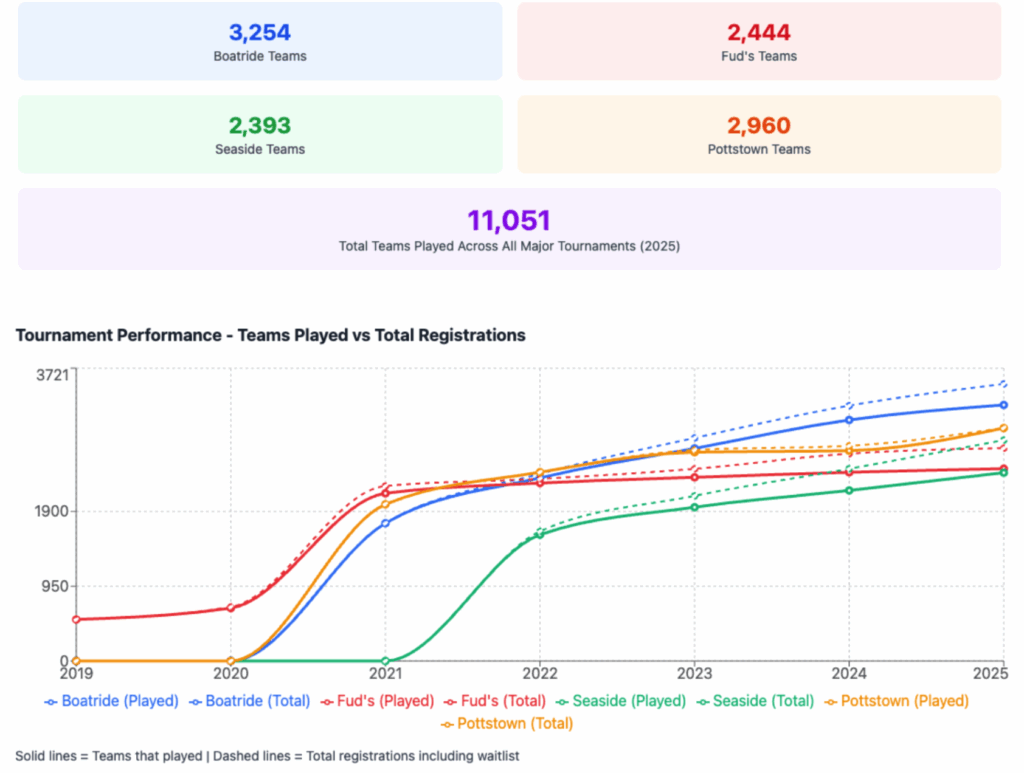

The four “super tournaments” on Volleyball Life (Fudpuckers, Pottstown, Waupaca, and Seaside) tell an even stronger story. These events are swelling year over year, with some divisions carrying waitlists of 70+ teams. Those waitlists alone could host their own tournaments. Despite organizers adding courts, raising prices, and tightening logistics each year to accommodate more players, demand still outpaces capacity.

2025 Tournament Summary

B. Overall College Beach Growth

The total number of beach volleyball programs climbed from 143 → 214 between 2020 and 2025. That’s more than growth, it’s a signal: schools are investing, and athletes are following. With 3,800 athletes competing this past season and programs growing 50% since 2020, college beach volleyball has real momentum.

Note: the apparent 2024 athlete dip was due to a data input change in our software; most programs used Volleyball Life (VBL) / College Beach Volleyball (CBVB) to manage competition lineups rather than full rosters during this change, so athletes that were on a roster but did not compete were inadvertently not accounted for. 2025 corrected for that.

Sponsored

College Recruitment: College coaches live on the sand in July, scouting in person for much of the month. The rest of the year, they lean on tools and touchpoints: Volleyball Life, Email, film, and camps, campus visits to manage evaluations and follow-up.

We built VBL+ to make this easier for college coaches, clubs and players going forward: volleyballlife.com/vbl-plus

IV. Market Dynamics, Power Shifts, and Risks

A. The Role of Clubs in the Junior Market

Junior championship events are saturated. When there are six national championships, you don’t really have a national championship, you have a crowded calendar. The “best” event shifts year to year: some athletes chase location, others prioritize dates. The consistent events on the same calendar date each year have the most steady growth, but there has not been a clear top sanctioning body on the juniors side outdoors in recent years.

With this fluctuation, the power has shifted to clubs as they help parents and players navigate which events to compete in. Club directors decide where to plant the flag and they invest real dollars to do it (flights, hotels, sending coaches, on-site support). Their endorsements shape outcomes: the events that clubs align on become the events that matter. When clubs coordinate and communicate early about where they’re going, that’s when a true championship feel emerges.

B. Plateau of NCAA D.1 Expansion

Despite some promising signs like the addition of University of San Diego beach volleyball, we are seeing a plateau of opportunities for beach volleyball athletes at the division 1 level. This is due to both program eliminations (see Utah) as well as upcoming NCAA Division 1 roster limitations.

This makes recruiting efforts especially important for high level beach volleyball athletes, putting a premium on which clubs they play for, which events they play, and how they organize their recruiting search and outreach..

While we anticipate a near-term dip in athlete counts at the division 1 level, we expect junior college, college club beach, and recreational adult participation to pick up any slack that top-level beach competition can’t satisfy.

If we want to see more growth of Beach Volleyball in the collegiate space it is going to require some advocacy from the masses. If the community demands it, the schools will build. To help, take some time to write a letter to a college Athletic Director, CC the indoor volleyball coach and all the assistant coaches. If you have the means to donate to the colleges, earmark the funds for building beach volleyball.

V. Strategic Outlook: Positioning for the Next Five Years

The numbers are clear: outdoor volleyball is not shrinking under the pressure of year-round indoor play — it’s holding and growing in the areas that matter most. But strength brings responsibility. Clubs, tournament directors, athletes, and even sponsors now play pivotal roles in shaping where the sport heads next.

For Tournament Directors

- Calendar Consistency Wins: Events anchored to the same weekend each year build loyalty and reliability. Clubs plan around them; athletes anticipate them. A floating calendar slot rarely achieves the same growth.

- Expand Capacity: Waitlists of 70+ teams are missed opportunities. Directors should explore satellite courts, longer event formats, and regional qualifiers that funnel into “super tournaments.” The appetite for competition is larger than the current footprint.

- Invest in Technology: Modern platforms like Volleyball Life have shown what’s possible in handling thousands of teams smoothly. Seamless registration, brackets, and live scoring are no longer luxuries.

For Club Directors

- Your Choices Define the Market: With six “national championships” on the calendar, no single sanctioning body holds the crown. Where you send athletes, invest travel dollars, and dedicate staff creates the championship feel parents and players chase.

- Recruiting Requires Strategy: With D1 growth plateauing, clubs need to diversify how they guide athletes. Showcase strategically at July events when coaches scout in person, but also build film libraries, leverage VBL+, and teach athletes to drive their own outreach.

- Expand the Funnel:D2, junior colleges, NAIA, and college club beach programs represent real and growing opportunities. Helping families understand this full pathway reduces pressure on the narrow D1 bottleneck.

For Athletes & Families

- Play the Long Game: Recruiting isn’t about chasing a “national title” — it’s about steady, visible development across competitive events. Prioritize quality film, consistent performance, and communication with coaches.

- Advocate for Growth: Families can accelerate collegiate expansion by writing to athletic directors, engaging indoor programs, and even earmarking donations for beach programs. The community voice is a driver of institutional investment.

For College Coaches

- Engage the Broader Calendar: July will always be central, but expanding recruiting touchpoints into spring and fall events can help programs reach more athletes earlier.

- Embrace Technology: With more competition for fewer roster spots, digital tools — VBL+, email film packages, and athlete profiles — are essential to keep evaluations manageable.

For Sponsors & Partners

- A Lifestyle Market Awaits: Volleyball combines athletic performance with a lifestyle aesthetic that aligns with fitness, wellness, and travel brands. Destination events are proving they can deliver thousands of engaged participants and spectators.

Risks & Opportunities

- Risks: Oversaturation of championships may fragment the market further. Weather-dependent regions will continue to cap growth without more indoor sand facilities. NCAA roster limits may tighten opportunities at the top level.

- Opportunities: Grassroots adult leagues, hybrid beach/grass tournaments, and partnerships with lifestyle brands can broaden reach. International exchanges with FIVB or AVP could elevate U.S. outdoor volleyball’s prestige.

Outdoor volleyball has the demand, the athletes, and the momentum. The next five years will be defined by who steps up to provide consistency, advocacy, and opportunity. Tournament directors can own the calendar, clubs can unify the championships, families can push for collegiate expansion, and sponsors can amplify the platform. The sport will thrive — the open question is: who will lead it?

This article was a collaboration between Kevin McColloch, Chief Operating Officer (Volleyball Life), Karissa Cook, Chief Product Officer (Volleyball Life), TJ Staples, JVA Beach Coordinator, Volleyball Life, CBVB, and JVA.